News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (March 20) | Fed to slow pace of balance sheet reduction in April, Trump to attend Digital Asset Summit in New York2Canary Capital files for first-ever Pengu ETF amid expanded crypto offerings3Bitcoin-focused Metaplanet appoints Eric Trump to advisory board

First Solana futures ETFs launch March 20

Grafa·2025/03/20 10:30

US lawmakers target stablecoin legislation by August

Grafa·2025/03/20 10:30

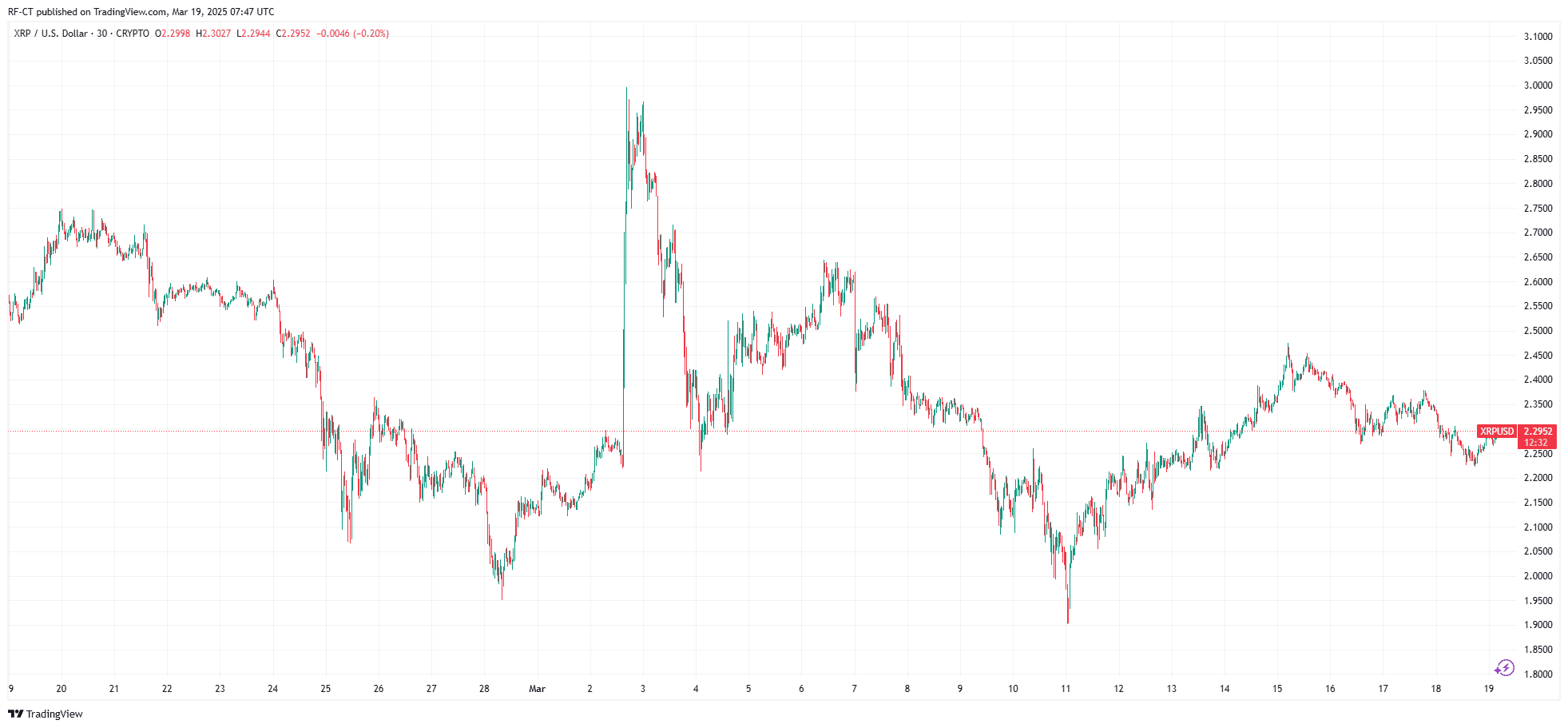

XRP Price Prediction: Can XRP Price Reach $10 after FOMC Meeting?

Cryptoticker·2025/03/20 04:11

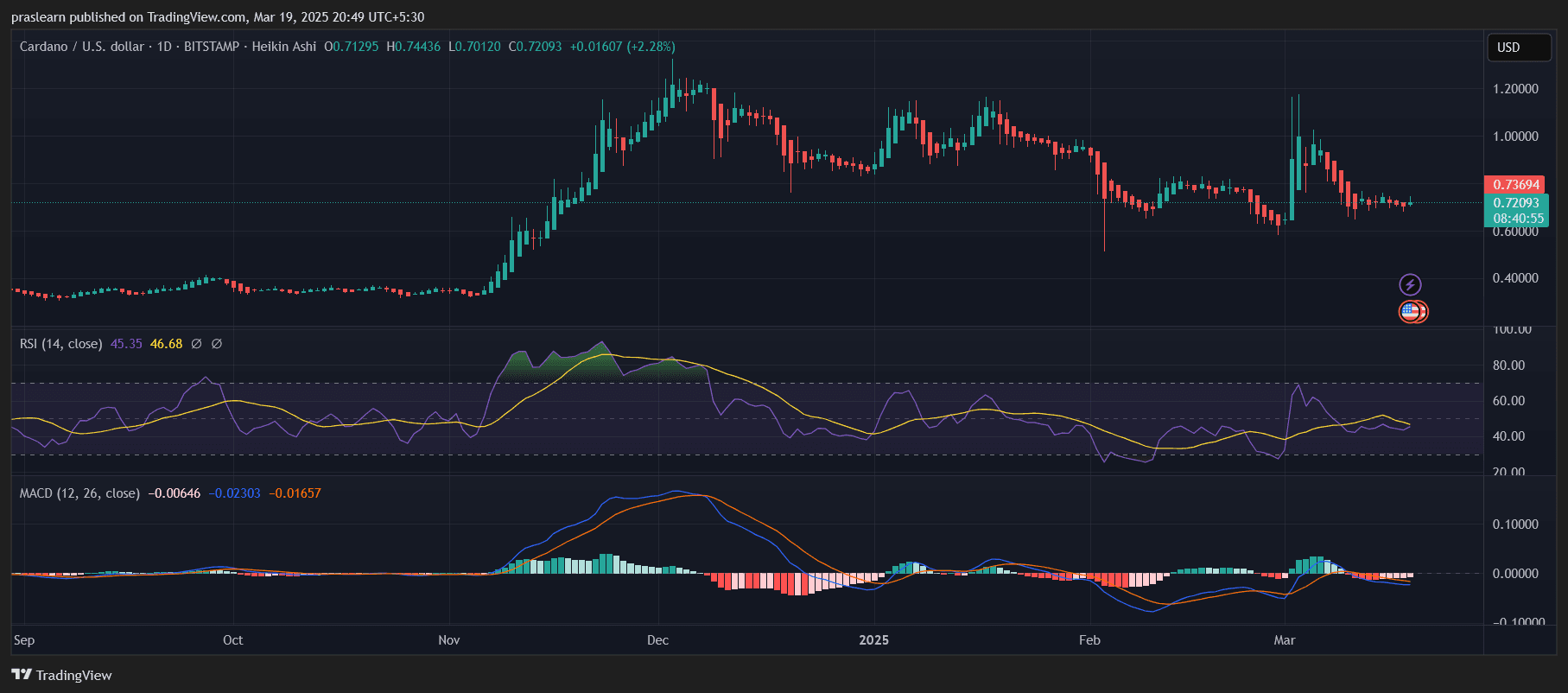

Can Cardano Price Reach $100?

Cryptoticker·2025/03/20 04:11

Kadena (KDA) Holds Key Support – Can the Double Bottom Pattern Spark a Recovery?

CoinsProbe·2025/03/20 03:22

XRP Pumps as SEC Drops Ripple Lawsuit – Key MA Resistance Holds the Key to Uptrend

CoinsProbe·2025/03/20 03:22

INJ and JASMY Approaches Falling Wedge Resistance – Could Breakout Spark a Recovery?

CoinsProbe·2025/03/20 03:22

SOL and SUI Approaches Falling Wedge Resistance – Could Breakout Spark a Recovery?

CoinsProbe·2025/03/20 03:22

Can Bitcoin Break $100,000? Key Levels Suggest Possible Surge

Cryptotale·2025/03/20 03:15

Bitcoin ETFs Gain Momentum as Ethereum Faces Steady Withdrawals; ETH Up 7% Today

Portalcripto·2025/03/19 22:11

Flash

- 14:08a16z: If the U.S. SEC provides guidance on token issuance, it can prevent the ownership of blockchain technology developed in the United States from being transferred overseasa16z stated at the cryptocurrency working group meeting of Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission: If the U.S. Securities and Exchange Commission could provide guidance on token issuance, it would stop the trend of issuing tokens only to non-U.S. citizens, which is essentially transferring ownership of blockchain technology developed in the United States overseas.

- 14:071confirmation founder: Ethereum has become the dominant ecosystem for RWA1confirmation founder Nick Tomaino posted on the X platform stating that the tokenization of Real World Assets (RWA) is accelerating, covering areas such as government bonds, stocks, bonds, private credit, bulk commodities, real estate and more. Among them, Ethereum has become the dominant ecosystem for the tokenization of real world assets.

- 14:04Analyst: The trade war will continue to pressure the crypto market until April, potential solutions may bring the next major catalystAccording to Cointelegraph, Nansen research analyst Nicolai Sondergaard stated that global tariff concerns will continue to pressure the market, at least until April 2nd. "I look forward to seeing how the tariff issue will develop from April 2nd onwards. Perhaps we will see some tariffs being cancelled, but this depends on whether all countries can reach a consensus. This is currently the biggest market driving factor. Risk assets may lack directionality until concerns related to tariffs are resolved, which could happen between April and July when positive market catalysts might emerge. Trump's reciprocal tariff rate is set to take effect on April 2nd, although Treasury Secretary Scott Bessent previously indicated it might be delayed. Apart from trade wars, high interest rates will also continue to suppress investors' risk appetite until the Federal Reserve finally begins cutting rates. According to the latest estimates from CME Group's FedWatch tool, there is currently an 85% chance that the Federal Reserve will keep interest rates unchanged at its next Federal Open Market Committee (FOMC) meeting on May 7th. Nexo digital asset investment platform analyst Iliya Kalchev said that The Fed believes inflation and recession-related worries are temporary - especially those about tariffs - which could be a positive signal for investors. "The market may now anticipate upcoming economic data with greater confidence. Cooling inflation and stable economic conditions could further boost investor confidence and drive Bitcoin and digital assets higher."