First Solana futures ETFs launch March 20

Volatility Shares will debut two Solana (CRYPTO:SOL) futures exchange-traded funds (ETFs) on March 20, marking the first U.S. ETFs tied to the cryptocurrency.

The Volatility Shares Solana ETF (SOLZ) and the 2X Solana ETF (SOLT) will track Solana futures contracts, offering standard and leveraged exposure with expense ratios of 0.95% and 1.85%, respectively.

The launch follows the Chicago Mercantile Exchange’s (CME) introduction of Solana futures on March 17, which saw $12.3 million in trading volume on its first day.

While lower than Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH) futures’ initial volumes, K33 Research noted Solana’s figures align proportionally with its market cap.

SOL’s price surged 12% to $136 ahead of the ETF launch, driven by rising open interest and derivatives activity.

Bloomberg ETF analyst Eric Balchunas called the ETFs a “first for an altcoin after Ethereum” but cautioned that demand may lag behind spot products.

Volatility Shares CEO Justin Young attributed the launch to “renewed optimism for crypto innovation in the U.S.,” referencing regulatory shifts under the Trump administration.

Analysts view the futures ETFs as a precursor to potential spot Solana ETFs.

Bloomberg Intelligence estimates a 75% chance of spot ETF approval by late 2025, citing parallels to Bitcoin and Ethereum’s regulatory paths.

Franklin Templeton, Grayscale, and VanEck are among firms seeking spot Solana ETF approval.

Derivatives data shows SOL’s open interest rose 39% to $8.3 billion, with futures volume climbing 38% to $8.33 billion.

Coinglass reports indicate leveraged long positions dominate, suggesting traders anticipate further price gains.

However, $21.8 million in liquidations over 24 hours highlight volatility risks.

CME’s Solana futures launch and the ETF rollout align with President Trump’s inclusion of SOL in a proposed U.S. crypto reserve.

While the SEC has not yet approved spot ETFs, industry observers note the futures-first approach mirrors historical precedents.

“Solana’s futures volumes normalised to market cap are comparable to Bitcoin and Ethereum’s early days,” Vetle Lunde of K33 Research stated.

Market participants now await SEC decisions on spot ETFs, which could amplify institutional adoption.

At the time of reporting, the Solana (SOL) price was $133.30.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

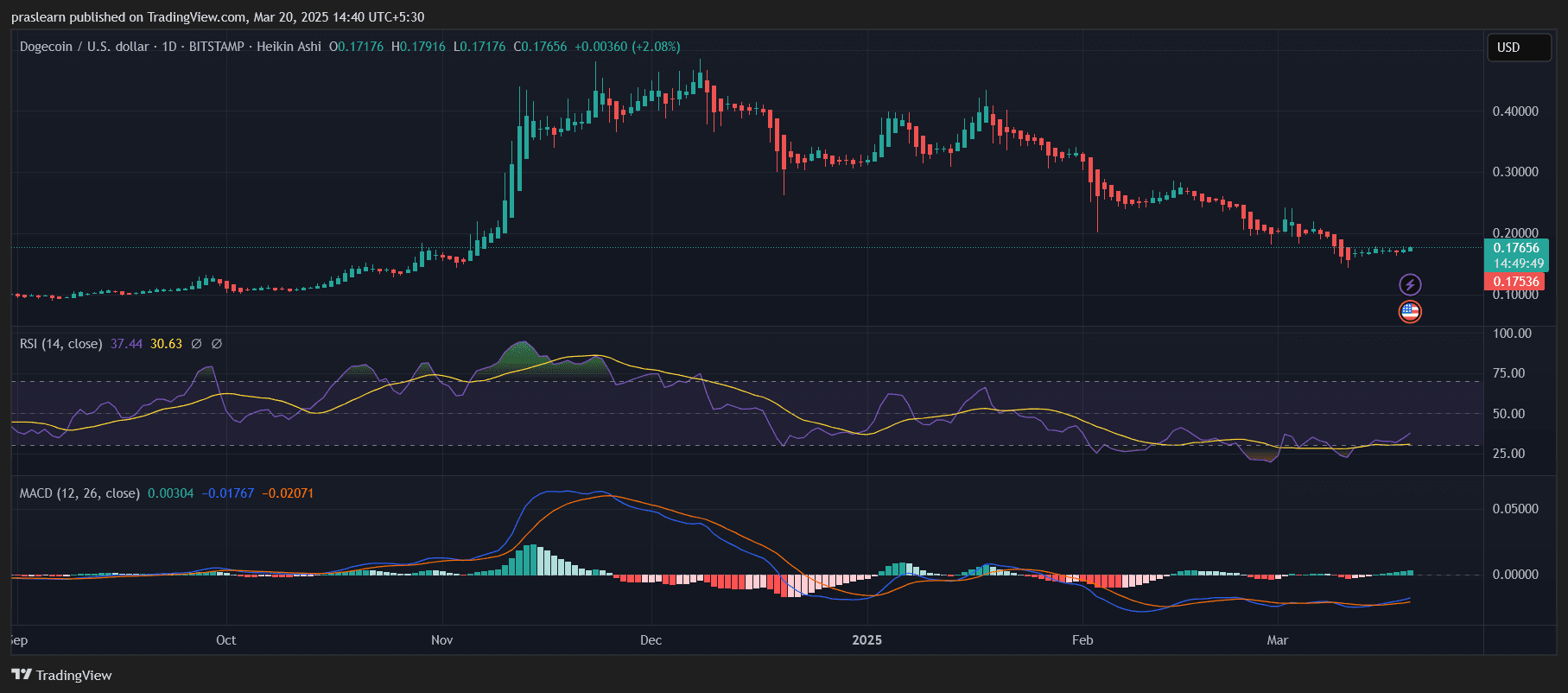

Dogecoin Breaks $0.1689 Amid Market Volatility – Can It Surge Past $0.1789?

Kryll (KRL) Creates Stealthy Bullish Divergence: What Traders Should Know

Bullish Divergence in Bitcoin: $90K Breakout or Fakeout?

SHIB vs DOGE: Can One of Them Make You a Millionaire?