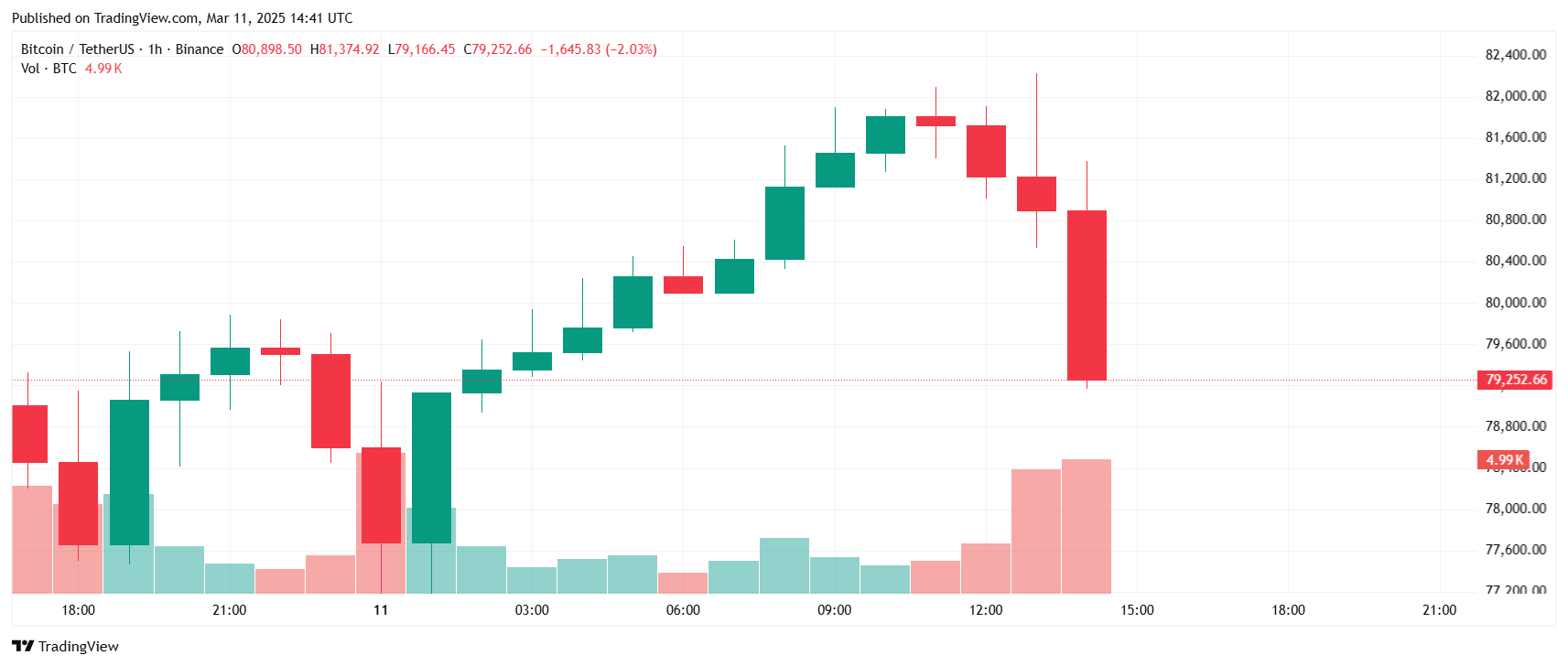

Is Ethereum Losing Its Deflationary Edge as ETH Burns Vanish?

Ethereum’s daily ETH burn rate, a key feature introduced by the 2021 EIP-1559 update to manage fees and supply, shows signs of declining, based on recent chart analysis highlighted by Miles Deutscher.

The chart shows that Ethereum’s profitability is the lowest it has been in a long time, with ETH burns trending to zero. This implies reduced network usage or fees, which conflicts with Ethereum’s deflationary concept, which relies on burning more ETH than is issued to validators.

The trend has sparked debate within the crypto community: some view it as a temporary lull before a possible recovery, while others express concern about profitability metrics and potential shifts in market sentiment.

There could be several reasons why this is happening, but first, it’s prudent to understand what’s actually going on.

Ethereum’s revenue is primarily driven by network activity, which generates transaction fees. Falling fees point to lower demand for block space, meaning fewer users are willing to pay high gas fees. Lower fee revenue can impact validators and Ethereum stakers, making ETH less attractive as a yield-generating asset.

It’s hard to exactly pinpoint the reasons for Ethereum’s decline, but lower on-chain activity might be one. This means that Ethereum’s DeFi ecosystem has slowed down, with lower trading volumes and fewer transactions on the mainnet. Then, since Ethereum’s burn mechanism is tied to gas fees, lower gas fees equals lower burns. Also, fewer high-fee transactions means less ETH is burned.

All of this is mostly speculation at this point, but it’s worth noting that there doesn’t have to be cause for concern just yet.

It might be still early to predict the outcome of the news, but there are at least a few options that should be noted.

For instance, in the cases when burns outpace issuance, ETH becomes deflationary. A trend towards zero burns raises the possibility of the total ETH supply expanding again, which could impact its perceived long-term value narrative.

Ethereum validators earn from transaction fees and MEV (Maximal Extractable Value). If fees remain low, staking rewards decrease, which would probably discourage participation in Ethereum staking.

We have yet to see what will happen in the end, but if on-chain activity rebounds, either through new innovations, higher DeFi volumes, or something else, Ethereum’s burn rate and profitability could quickly recover.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Impact of Exchange Promotions on $PARTI Trading Volume and Market Perception

The launch and adoption of a new cryptocurrency often depend on more than just its technology or utility—exchange promotions play a crucial role in influencing trading volume, liquidity, and market perception. In the case of $PARTI (Particle Network’s native token), strategic promotional campaigns, particularly those launched by exchanges like MEXC, have significantly impacted its early trading dynamics.

This analysis explores how exchange-led promotions—such as airdrop rewards, trading competitions, and liquidity incentives—affect the trading volume, investor interest, and overall market perception of $PARTI.

1️⃣ Understanding Exchange Promotions and Their Importance in Crypto Trading

Cryptocurrency exchanges often implement promotional campaigns to attract traders, enhance liquidity, and establish strong price action for newly listed tokens. These promotions can include:

Airdrop Campaigns – Distributing free tokens to new and existing traders to increase engagement.

Trading Competitions – Offering rewards based on trading volume, encouraging high activity.

Staking & Yield Farming Incentives – Allowing users to earn passive income by holding and staking the token.

Zero-Fee Trading Periods – Encouraging more transactions by removing trading fees for a limited time.

For $PARTI, one of the most impactful promotions was MEXC’s 150,000 USDT Airdrop+ rewards program, which aimed to drive early trading volume and attract investor interest. (Bitcoinist)

2️⃣ Immediate Impact of Promotions on $PARTI Trading Volume

A. Surge in Trading Volume Post-Listing

After its listing on MEXC, CoinEx, and other exchanges, $PARTI experienced a significant surge in trading volume, largely due to promotional incentives. This follows a common trend where:

Airdrop recipients trade the free tokens, leading to a short-term volume spike.

Traders participate in competitions, increasing buy and sell orders to qualify for rewards.

Market makers provide liquidity support, further driving activity.

For example, MEXC's promotional campaign not only boosted initial demand but also enhanced the token's visibility in the broader crypto market.

B. Short-Term vs. Sustained Trading Activity

While promotional campaigns drive an initial trading volume surge, sustainability depends on:

1. Long-term investor confidence in the project.

2. Utility-driven demand (staking, governance, ecosystem integration).

3. Institutional participation and deeper liquidity pools.

In many cases, a drop in trading activity follows after promotional incentives end, as speculative traders exit once rewards are distributed. This is why strategic liquidity management and community engagement are crucial after the promotional phase.

3️⃣ Market Perception and Investor Sentiment Toward $PARTI

A. Enhanced Visibility & Exchange Credibility

A well-structured promotion can positively shape market perception, making a token more attractive to investors.

Listings on reputable exchanges (e.g., MEXC, CoinEx) enhance credibility, reassuring traders about legitimacy.

Marketing & community hype during promotions can create a strong early adopter base.

For $PARTI, the MEXC airdrop campaign and exchange-backed promotions have positioned it as a high-interest token, drawing attention from retail and institutional investors alike.

B. Potential Risks: Pump & Dump Scenarios

Despite the benefits, exchange promotions also introduce risks:

1. Speculative Trading – Some traders buy and sell quickly to capitalize on incentives, leading to price volatility.

2. Dumping Post-Airdrop – Once users receive free tokens, they might sell immediately, causing short-term price dips.

3. Unsustainable Hype – If the project lacks strong fundamentals, hype-driven price increases can fade, leading to long-term depreciation.

To mitigate these risks, $PARTI’s team must ensure real utility, community engagement, and continuous ecosystem development.

4️⃣ Long-Term Implications for $PARTI’s Market Growth

A. Building Organic Demand Beyond Promotions

While promotions provide an initial push, sustainable growth depends on:

Real-world use cases – Integrating $PARTI within DeFi, NFT, and SocialFi ecosystems.

Staking & Governance – Encouraging long-term holding and community participation.

Institutional Adoption – Securing partnerships that expand the token’s market presence.

B. Exchange Liquidity and Price Stability

Increased liquidity pools on multiple exchanges help reduce price volatility.

Multi-chain expansion (Ethereum, Solana, Binance Smart Chain) attracts more users.

If Parti.com continues integrating $PARTI into its Web3 ecosystem, the token can sustain growth beyond promotional hype.

🆑 Conclusion:

The Lasting Effects of Exchange Promotions on $PARTI

Key Takeaways:

✔ Exchange promotions (like MEXC’s $150,000 USDT airdrop) boost early trading volume and visibility.

✔ Short-term trading activity surges due to speculative interest but long-term sustainability depends on token utility.

✔ Exchange credibility & liquidity management are critical for preventing post-promotion price crashes.

✔ $PARTI must focus on ecosystem growth, governance, and institutional adoption to maintain its value.

⚫By leveraging its Web3 infrastructure, SocialFi applications, and cross-chain expansion, $PARTI has the potential to transform early promotional momentum into long-term success.

$PARTI

Lowest price

Lowest price Highest price

Highest price