Altcoins Struggle as Market Sentiment Wavers: What Lies Ahead for PENDLE and TAO?

In Brief The leading cryptocurrency remains stagnant while altcoins experience a decline. Analysts are updating forecasts for PENDLE and TAO amidst low investor interest. Liquidity issues are causing significant challenges for many cryptocurrencies in the market.

In the first Sunday of the second quarter, the leading cryptocurrency remains stagnant, while altcoins continue to decline. Investors are anxiously awaiting signs of compromise from Trump as early as Monday morning. This raises questions about the reasons behind the weakness of altcoins and what analysts are predicting for PENDLE and TAO.

PENDLE and TAO Coin Insights

Investor interest is low, and trading volumes are dwindling, with anticipated recovery in the cryptocurrency markets still not in sight. As investor losses continue to accumulate, the possibility of Trump not backing down on tariffs increases unease. The stock markets are displaying bearish trends, and Fed Chairman Powell has ignored calls for rate cuts.

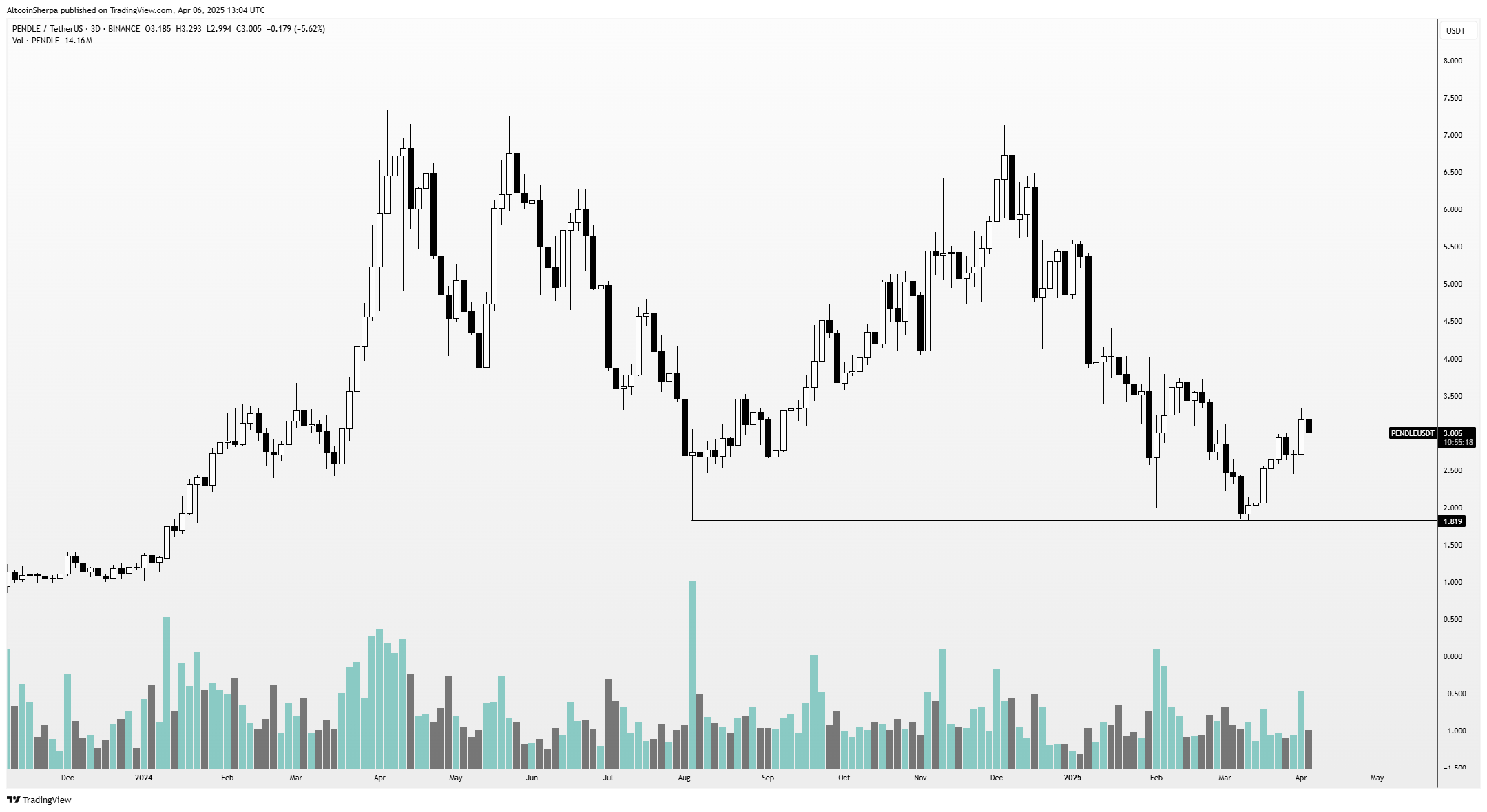

Amid this discouraging market atmosphere, analysts like Altcoin Sherpa are updating their forecasts for altcoins. Sherpa commented on PENDLE, stating:

“PENDLE, a solid coin I have been eyeing for some time, showed a strong performance last week. I wouldn’t be surprised to see it drop back to the mid-$2 range, but this depends on BTC price movements. The market structure is still bearish, and breaking above $3 would change my perspective and trigger a buying mode.”

Looking at TAO Coin, analysts consider the current fluctuations normal when compared with past movements. Some analysts hold a notably positive view on TAO, with Sherpa among them.

“TAO has had a rough period with over a 70% drop from its ATH, but looking at price history, that is quite normal. I still expect a price movement similar to the yellow box, where it consolidates and moves around. I’m not saying it will work the same way as before, but it should do well when market conditions stabilize. It remains one of the best AI altcoins on the market.”

Why Are Altcoins Not Rising?

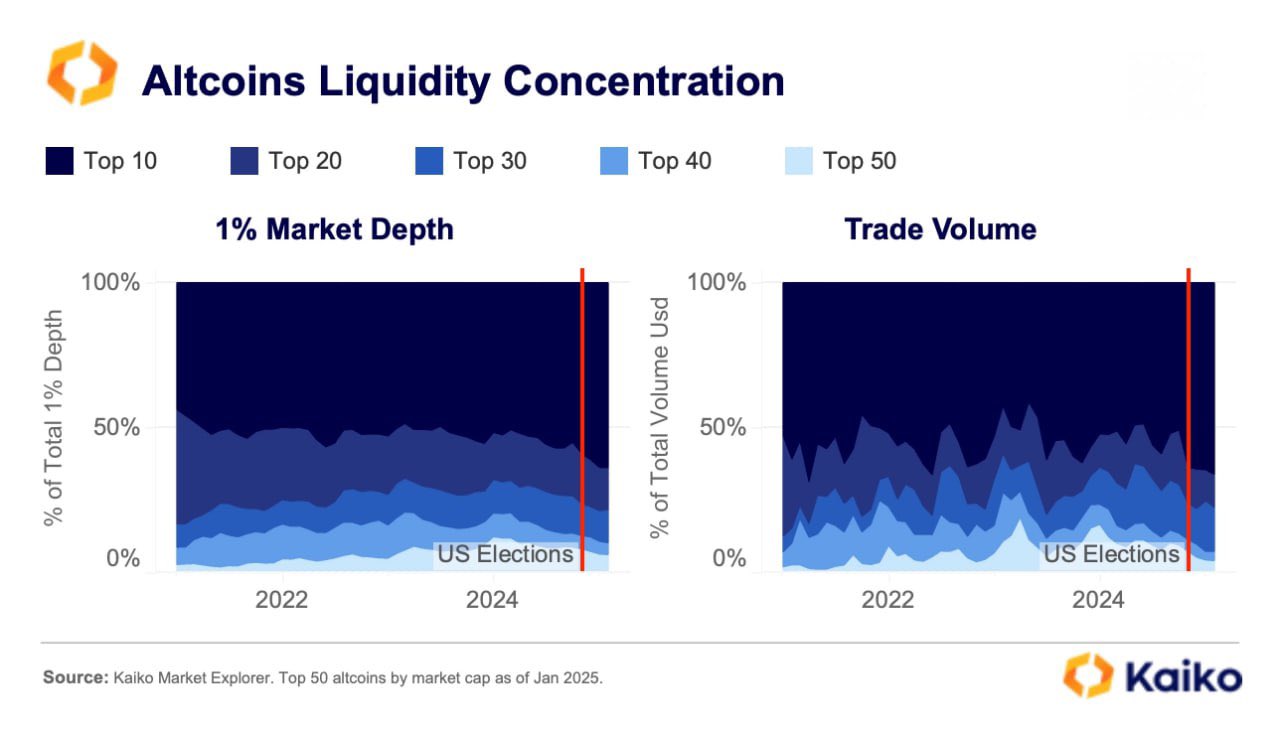

The recent weekly issuance of millions of tokens, which resulted in protests against the Solana $107 network, has significantly impacted liquidity. Additionally, the rise of meme coins and L2 solutions, coupled with aggressive listing policies from centralized exchanges, has led to an influx of cryptocurrencies. Will Clemente highlights this liquidity disparity with a corresponding graph.

“Liquidity distribution in crypto is becoming more pronounced than ever. The majority of liquidity and volume is now concentrated in the top 10 altcoins. There are too many tokens.”

The table shows that a vast number of cryptocurrencies are sharing a limited amount of liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Troller Cat’s Tail Is Twitching—Something Big’s Brewing in The Upcoming Meme Coin Presale

Meme coins weren’t always taken seriously. They started as internet jokes with little utility and zero roadmaps.Troller Cat Isn’t Playing Around—This Meme Coin Is Armed With StrategyMeme Coin Culture in Latin America Is Roaring—and Troller Cat Fits Right InWhitelist Access: The Smartest Way to Get Ahead of the HerdConclusion: This Is the Meme Coin Presale to Watch—Before the Cat’s Out of the Bag

Ripple vs Ethereum: XRP Will Outperform ETH by 2028, Reveals Standard Chartered

BlackRock Remains Cautious in Recommending Cryptocurrencies to Large Investors

Trump, Japanese PM Discuss Trade Tariffs Amid Negotiations