Trump’s Tariffs Trigger Crypto Market Dip as Fear Spikes

- Bitcoin drops 2.6% to $82,876 following Trump’s sweeping tariff announcement.

- Ethereum has fallen by over 6% as the total crypto market cap sheds $2.7 trillion.

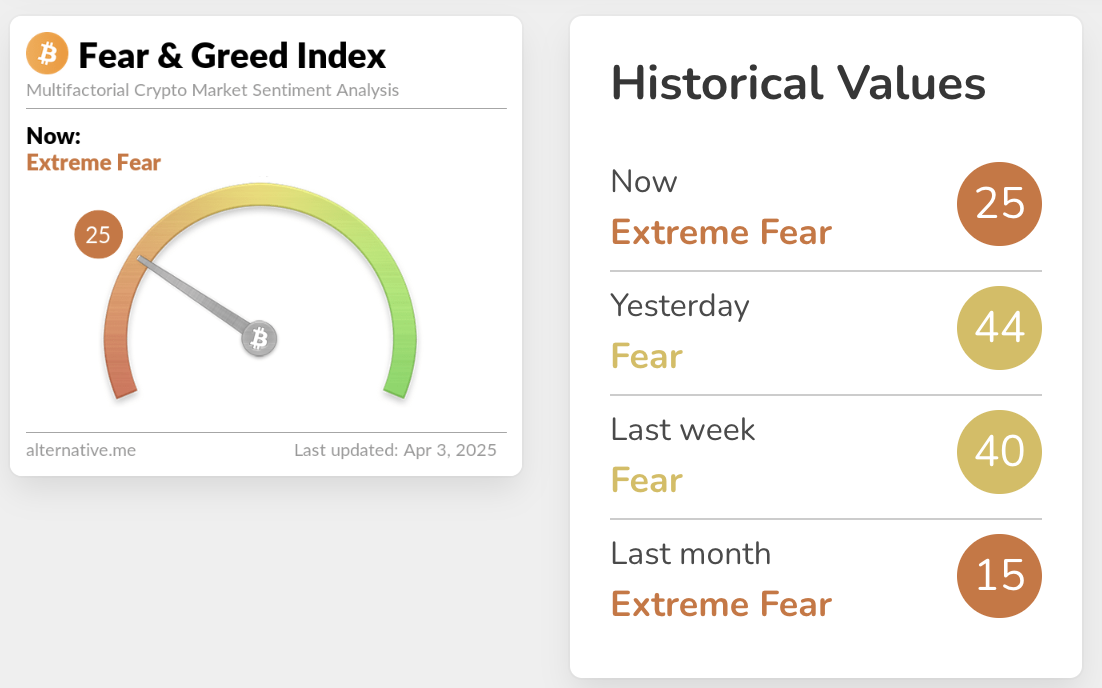

- Crypto Fear & Greed Index plunges to 25, indicating “extreme fear” among investors.

Cryptocurrency markets have seen a downturn after US President Donald Trump declared a national emergency and announced comprehensive tariffs that target global trade partners. The unexpected policy shift affected the financial markets alongside traditional investments and cryptocurrencies.

The Trump administration revealed plans to implement a 10% blanket tariff on all countries beginning April 5. China will bear the brunt with a 34% tariff, while the European Union and Japan will face 20% and 24% levies, respectively. During his April 2 address from the Rose Garden at the White House, Trump justified the measures by stating the US is now charging countries “approximately half of what they are and have been charging us.”

Initially, cryptocurrency markets showed a brief positive reaction to the news of a 10% baseline tariff. However, once investors processed the full scope of the trade measures, digital assets began to decline. Bitcoin, which was showing a relief rally to $88.4K, reversed course and dropped approximately to $83,200 at press time.

Ethereum also dropped as prices fell from $1,950 to $1,800 following the tariff announcements. The overall cryptocurrency market felt similar pressure as the total market capitalization dropped to $2.67 trillion, as investors reassessed risk exposures across their portfolios.

Related: https://cryptotale.org/jetking-raises-%e2%82%b96-6-cr-to-enter-bitcoin-and-blockchain-space/

The market sentiment deterioration was exhibited in the Crypto Fear & Greed Index. The index plummeted to a reading of 25 in its April 2 update, placing it firmly in “extreme fear” territory. Traditional financial markets have shown comparable stress responses to the tariff news. According to a financial analysis resource, The Kobeissi Letter, the S&P 500 stock market index erased over $2 trillion in market capitalization following the announcement.

Source: Alternative

The synchronized downturn across both crypto and traditional markets shows the increasingly interconnected nature of various asset classes during periods of macroeconomic uncertainty. While cryptocurrencies were once touted as potential safe havens during global trade tensions, the current market reaction suggests that digital assets remain vulnerable to broad risk-off sentiment triggered by geopolitical developments.

The post Trump’s Tariffs Trigger Crypto Market Dip as Fear Spikes appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mitsubishi UFJ’s stablecoin is coming to Japan

Ronin Bridge CCIP Migration Begins with Chainlink-Powered Security

Celo and Bando Makes Crypto Easy for Buying Gift Cards and Data

VeChain Partners with 4ocean to Advance Ocean and Land Sustainability with Blockchain