PENDLE Sees Whale Accumulation – Will This Breakout and Retest Push It Higher?

Date: Wed, April 02, 2025 | 06:59 AM GMT

The cryptocurrency market is showing mixed performance today as global macroeconomic factors come into play, with U.S. President Donald Trump expected to impose reciprocal tariffs on all countries.

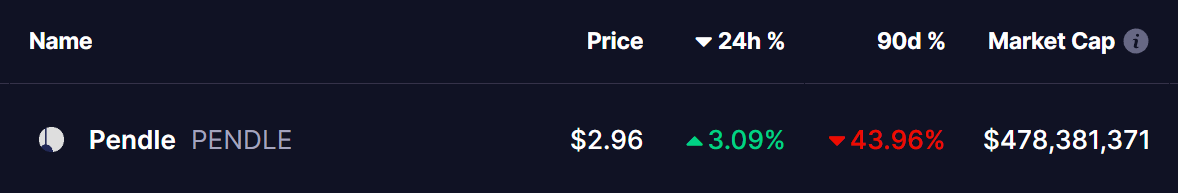

Meanwhile, in the altcoin space, Pendle (PENDLE)—a DeFi protocol token—is trading in the green with minor gains, boosted by whale accumulation and a bullish technical setup. After experiencing a sharp 43% correction over the last 90 days, PENDLE now appears to be positioning itself for a potential recovery.

Source: Coinmarketcap

Source: Coinmarketcap

Whale Accumulation

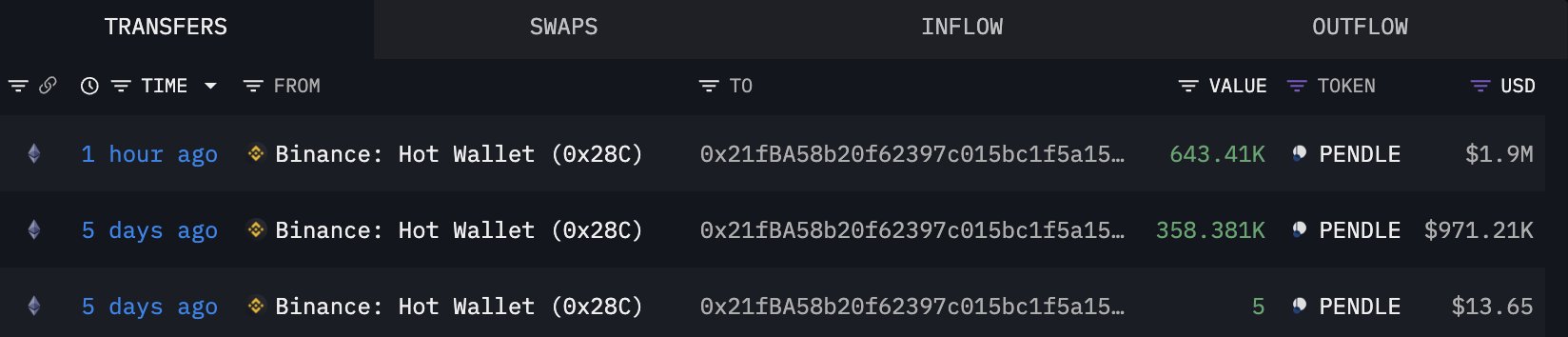

As PENDLE’s technical setup hints at an upside move, whale activity has surged, indicating growing interest from large investors. According to Lookonchain , a blockchain analytics platform, five newly created wallets withdrew 2.66 million PENDLE ($7.9 million) from Binance in the past five days.

Source: @lookonchain (X)

Source: @lookonchain (X)

Historically, when whales begin accumulating at depressed price levels, it signals confidence in an impending price rebound, as demand starts to outpace supply.

Breakout and Retest – A Bullish Setup?

One of the key drivers behind this whale activity could be PENDLE’s recent technical breakout. The token recently broke out of a falling wedge pattern that had kept its price in a prolonged downtrend. The breakout occurred on March 24, when PENDLE surged past the wedge’s upper boundary, reaching a local high of $2.99.

PENDLE Daily Chart/Coinsprobe (Source: Tradingview)

PENDLE Daily Chart/Coinsprobe (Source: Tradingview)

However, last week’s broader market downturn led PENDLE to pull back and retest its breakout trendline at $2.45. After successfully bouncing off this support, PENDLE is now trading in the $2.96 resistance zone, with the 50-day moving average (MA) acting as a support level.

If PENDLE manages to break above its next major resistance—the 100-day MA, it could spark a rally toward the next key resistance at $4.03, representing a potential 36% upside from current levels.

Final Thoughts

The combination of whale accumulation and a strong technical breakout setup puts PENDLE in a favorable position for a potential recovery. However, traders should keep an eye on key resistance levels and overall market conditions before making any moves.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

4 Best Cryptos to Buy Now as Fed Eyes Emergency Rate Cut

Dogecoin Makes Financial History with First-Ever Backed ETP Listed in Europe

XRP 2X ETF Surpasses Solana on Launch Day — But Trails Bitcoin

Bitwise Reaffirms Bold $200K Bitcoin Forecast Amid Global Trade

Bitwise has reiterated its optimistic Bitcoin forecast, maintaining a $200,000 price target for 2025 despite increasing global trade tensions.