Samson Mow Says Bitcoin Bear Trap: What’s Next at $82,516.97?

Bitcoin Price Analysis

Bitcoin Price Analysis

Bitcoin has slipped to $82,516.97, down 1.55% in 24 hours, triggering concerns of a deeper correction. But according to Samson Mow , this breakdown is a “bear trap”—a fakeout designed to flush out weak hands before a larger move higher.

Mow remains firm on his $1 million BTC target, arguing the recent sell-off doesn’t reflect fundamentals. Bitcoin still holds a $1.64 trillion market cap, with 19.84 million BTC in circulation.

While Mow sees upside ahead, charts tell a different story. BTC has broken below a symmetrical triangle, with the former support at $83,650 now acting as resistance.

Bitcoin Technical Setup Signals Caution

The recent breakdown from the symmetrical triangle pattern has turned $83,650 into a key resistance zone, stalling any immediate rebound. A bearish engulfing candle under this level signals continued selling pressure.

- Current Price: $82,516.97

- 24H Volume: $19.93B

- Resistance Levels: $83,650, $85,231, $86,841

- Support Levels: $82,000, $81,278, $79,990

- 50 EMA: $85,231 (above current price)

- RSI (14): 27.63 (oversold)

The RSI remains oversold, but without bullish divergence, offering no clear sign of reversal. A breakdown through the triple bottom around $83,000 further weakens the structure, placing $81,278 and $79,990 in view. Volume near current levels is also subdued, reflecting a lack of strong buyer support.

What Comes Next for Bitcoin?

The key question is whether this is the trap Mow describes, or the start of a broader correction. Broader sentiment is mixed, with macroeconomic pressure and tight liquidity weighing on high-risk assets.

A confirmed reclaim of $83,650, followed by a breakout above the 50 EMA at $85,231, would be an early signal of bullish recovery. Otherwise, continued failure at current levels risks a slide below $80,000.

Key Signals to Monitor:

- Break and close above $83,650

- RSI divergence or recovery above 30

- Trading volume increase on bounce attempts

- Support holding at $81,278 or $79,990

Until these conditions are met, Bitcoin remains vulnerable. Whether Samson Mow’s call plays out will depend on how markets respond in the days ahead.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.002425 per BTCBULL

- Total Raised: $4M / $4.5M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP forecasted to reach $43.94 by 2030 amid market shifts

Bitcoin surges past $80,000 amid tariff policy shift

AAVE surges 13% as buyback proposal approved by tokenholders

Crypto derivatives remains resilient in March as spot trading took bigger hits

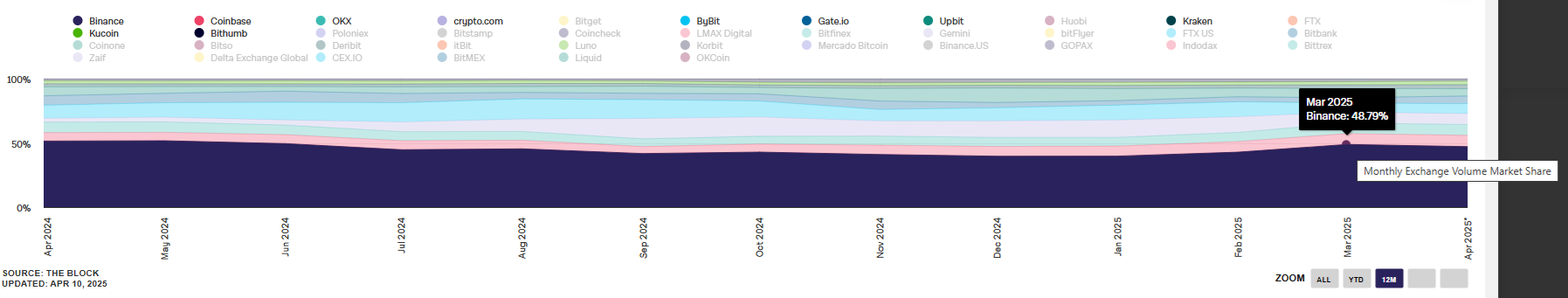

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.