World Liberty Financial Makes Bold Moves Despite Significant Losses

In Brief World Liberty Financial faces significant losses despite new coin acquisitions. The project's future investment strategies are under scrutiny. Investors are concerned about the sustainability of WLFI's approach.

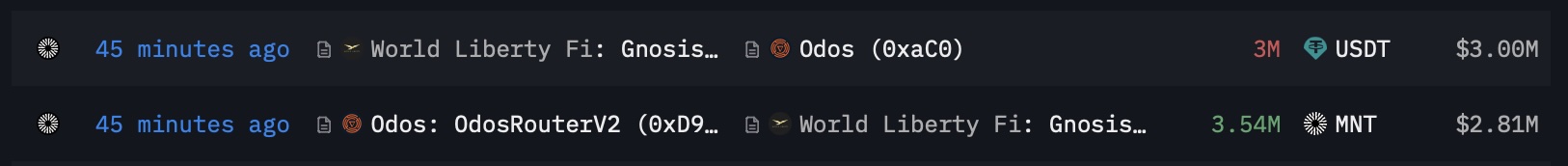

The World Liberty Financial (WLFI) project, backed by the Trump family, has made headlines with its recent acquisition of 3,539,000 Mantle (MNT) coins for a total of $3 million. This purchase, which cost an average of $0.84 per coin, is part of WLFI’s strategy to expand its cryptocurrency portfolio. However, despite this expansion, the project is currently facing a substantial loss of approximately $109 million from a total investment of $343 million. The performance of its other investments, which include altcoins like ETH, WBTC, TRX , LINK , and more, raises questions about the project’s sustainability going forward.

World Liberty Financial Continues Acquiring MNT Coins

WLFI has recently gained attention for its investment in MNT coins, acquiring a total of 3,539,000 through a $3 million purchase. Despite diversifying its portfolio, the project is grappling with significant financial losses, putting its future investments under scrutiny.

World Liberty Financial – Altcoin MNT Acquisition

World Liberty Financial – Altcoin MNT Acquisition

A significant portion of WLFI’s total investment of $343 million has depreciated. Although investments were made in strong altcoins like ETH, WBTC, and TRX, the negative market conditions have resulted in a staggering loss of $109 million. This situation highlights the vulnerability of the project despite the Trump family’s involvement.

What is World Liberty Financial?

Supported by the Trump family, World Liberty Financial is positioned within decentralized finance (DeFi) projects. The initiative is recognized for its investments in various cryptocurrencies and draws attention with its broad portfolio that includes both popular and emerging altcoins.

WLFI aims to spread risk by adding diverse cryptocurrencies to its portfolio while targeting high return potential. However, with many of its investments depreciating, the project is drawing investors’ concern. The upcoming investment strategies and measures to mitigate losses remain uncertain, highlighting the need for close observation from stakeholders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Asia holds crypto liquidity, but US Treasurys will unlock institutional funds

[Initial Listing] Bitget Will List KernelDAO (KERNEL) in the Innovation, LSD and DeFi Zone.

Uniswap front-end transaction fees have reached $182.88 million

Trump Exempts Tech Devices from New Tariffs

Trump exempts smartphones, computers, and chips from new tariffs, easing pressure on the tech and crypto industries.Major Tech Relief as Trump Exempts Devices from TariffsCrypto Sector Also Stands to BenefitPolicy Shift Aims to Stabilize Markets