Trump's top crypto advisor open to budget-neutral gold-to-Bitcoin reserve swap

Key Takeaways

- Bo Hines discussed the idea of using US gold reserves, stored in Fort Knox, to purchase Bitcoin.

- Senator Lummis has recently reintroduced the Bitcoin Act for a major US Bitcoin acquisition.

Bo Hines, Trump’s Crypto Council Chief and head of the Presidential Council of Advisers for Digital Assets, also known as the Crypto Council, said he is open to exploring an exchange of Fort Knox gold reserves for Bitcoin, as long as it has no effect on the government’s budget balance.

“If it’s budget neutral and doesn’t cost a taxpayer a dime, you kind of exchanging one for the other,” said Hines in a recent interview with FOX Business journalist Eleanor Terrett. He was asked whether it would be possible to sell some of the US gold reserves to buy Bitcoin.

Hines noted, however, that the working group is not committed to any specific strategy at the time. Instead, the group actors are willing to explore various “creative ideas” and Hines himself wants to hear diverse perspectives.

“One thing that’s different about this White House is we welcome in new ideas, innovative solutions,” Hines said.

When asked whether the administration would include other crypto assets besides Ethereum, XRP, Solana, and Cardano—four major altcoins that Trump mentioned in his first national crypto reserve statement, Hines stressed that they support innovations across many crypto ecosystems.

He also clarified, like David Sacks had previously done , that the four altcoins were mentioned due to their market cap dominance.

Lummis’ proposal to sell off a portion of Fed’s gold holdings

Senator Cynthia Lummis previously suggested the US Treasury Department should consider converting a portion of the Federal Reserve’s gold holdings into Bitcoin to create a national Bitcoin reserve.

Last year, Lummis introduced the BITCOIN Act (Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide), which proposed acquiring 1 million Bitcoin, approximately 5% of the total circulating supply, through the sale of Fed gold certificates.

The proposal aligns with Trump’s plans to establish a Bitcoin reserve, though the President’s initial strategy focused on utilizing seized government Bitcoin holdings.

“We already have the financial assets in the form of gold certificates to convert to Bitcoin,” Lummis said in a November interview with Bloomberg. “So the effect on the US balance sheet is pretty neutral.”

Lummis’ bill did not progress during the 2023-2024 Congress session. However, last week, she reintroduced the Bitcoin ACT (S.954) at a Bitcoin-focused conference hosted by the Bitcoin Policy Institute, aiming for the US to purchase 1 million Bitcoin.

The bill’s text has not been submitted as of March 21.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

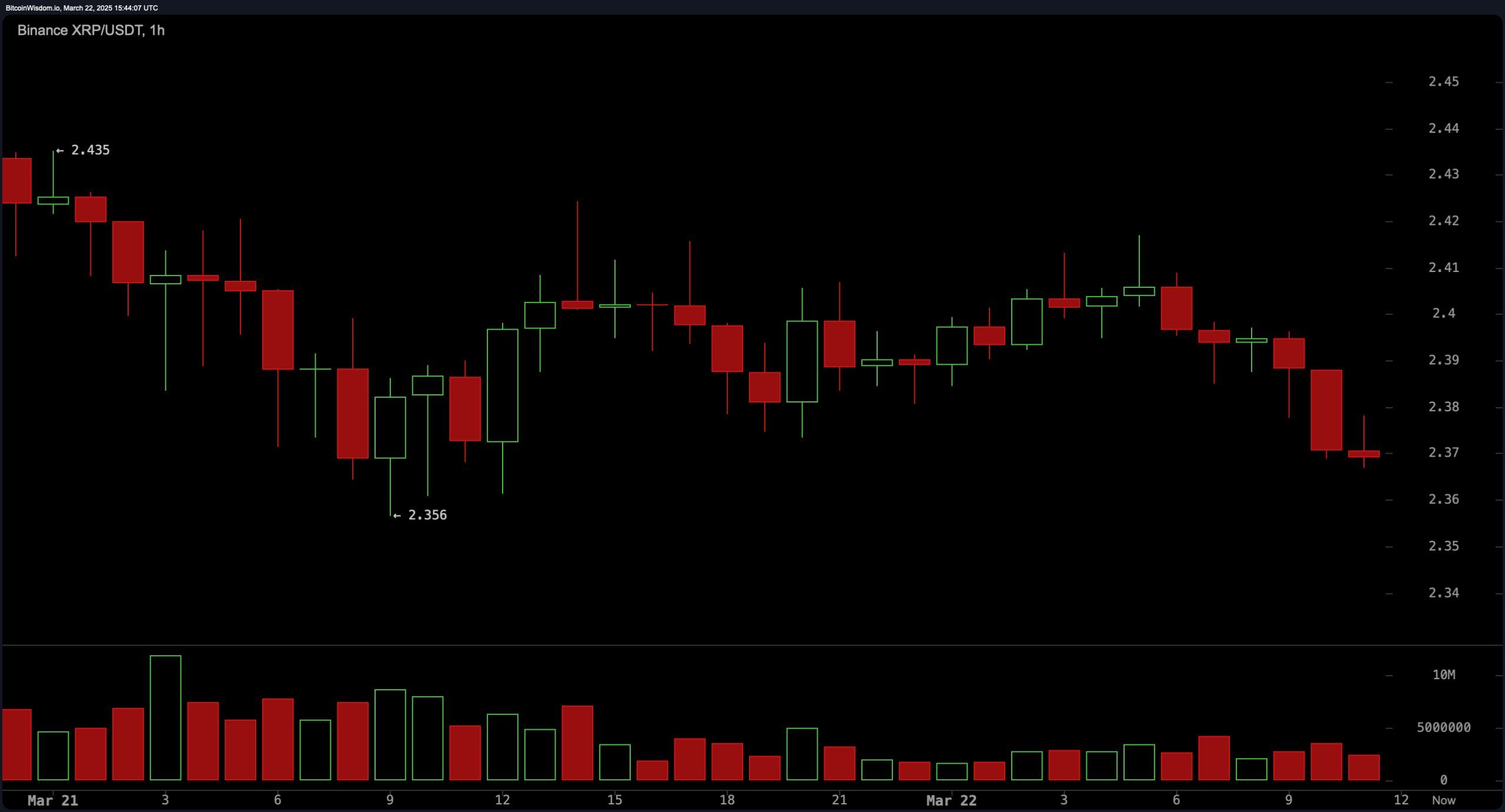

XRP Price Update: XRP Teeters on $2.35 Support—Next Move Critical

Weekly Crypto Regulation News Roundup: SEC Ends Ripple Case, Trump Calls for Stablecoin Regulation

Regulatory realignment unfolds as the SEC steps away from a prolonged crypto case while policy makers rally for simple stablecoin rules to reshape market oversight and boost investor confidence.

BaFin Bans Ethena’s USDe Token in Germany Over Approval Process Flaws

German regulators’ latest clampdown forces crypto issuers to rethink internal controls—a potential catalyst for industry-wide reform that could reshape how synthetic tokens meet EU compliance standards.

Crypto Industry Super PAC Endorses Republican Candidates in Florida Special Elections

The network includes Fairshake, Protect Progress, and Defend American Jobs, the latter taking the lead in campaign spending.