North Korea Becomes 3rd Largest Government Bitcoin Holder

- North Korea ranks 3rd in govt BTC holdings after Lazarus converts $1.4B ETH to 13,562 BTC.

- Bybit implemented around 13 bounty programs in a bid to recover stolen funds.

- North Korea now exceeds El Salvador and Bhutan in Bitcoin holdings as national reserves.

After hacking the crypto exchange Bybit, the North Korean hacker group Lazarus group converted the stolen Ethereum into Bitcoin. This conversion helped the North Korean government to jump into the charts of top global Bitcoin holders. The country’s digital asset reserves have surpassed El Salvador (6,117 BTC), and Bhutan (10,635 BTC) and are now second to the United States (198,109 BTC) and the United Kingdom (61,245 BTC).

Bybit Hack Recovery Efforts

Earlier this month, Bybit CEO Ben Zhou stated in an X post that 77% of the stolen funds remain traceable, 20% have gone dark and 3% have been frozen. Additionally, 83% (417,348 ETH) valued at approximately $1 billion, has been converted into BTC through Thor Chain, a decentralized cross-chain swap protocol.

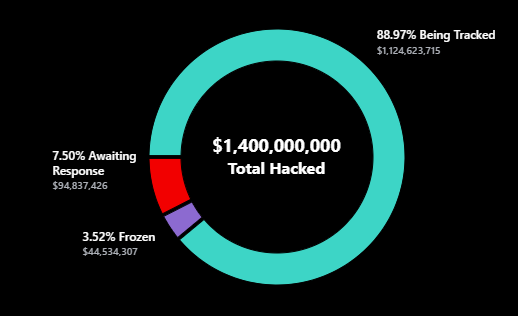

To mitigate losses, Bybit launched a $140 million bounty program, LazarusBounty, offering a 10% recovery incentive, 5% for entities freezing funds, and 5% for those tracing them. So far, 13 bounty participants have assisted, leading to $2.2 million in USDT payouts as rewards. Currently, 88.9% of stolen funds are being tracked, 7.5% await response, and 3.52% have been successfully frozen.

Related: Bybit Receives $600M ETH From Mirana Ventures Post $1.5B Hack

North Korea’s Crypto Tactics Raise Security Concerns

The Lazarus group, widely known as North Korea’s hacker group, has changed cryptocurrency theft into a crucial funding mechanism to bypass economic sanctions. Apart from Bybit, several firms have become victims of the hacking group. In November 2014, Sony Pictures was hacked, followed by Bangladesh Bank in 2016, and WannaCry in 2017. Further, from April 2017 to February 2025, the hacker group shifted its focus from banks to crypto exchanges, executing about 10 hacks on multiple crypto exchanges.

These hacks expose vulnerabilities in crypto platforms, raising concerns over the industry’s cybersecurity resilience. Weak security infrastructure and regulatory gaps make digital assets a target, potentially destabilizing global investor confidence and broader financial markets. Also, with the large quantity, concerns rise over a potential sell-off, which could shake the crypto market. Notably, in 2024, Germany had executed a similar plan, wherein, it sold nearly 50K BTC increasing supply and pressuring prices.

The post North Korea Becomes 3rd Largest Government Bitcoin Holder appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano (ADA) on verge of 20% breakout as social sentiment indicator hits 4 month high

Congress on track for stablecoin, market structure bills by August: Blockchain Association

VeChain Secures MiCAR Compliance for VET and VTHO

VeChain meets MiCAR compliance as ESMA confirms VET and VTHO whitepapers, boosting regulatory trust.What MiCAR Compliance Means for VeChainStrengthening VeChain’s Market Position

Top Altcoins to Buy Now: BlockDAG, Aave, Ethereum, & Solana—Which Will Offer the Best Returns in 2025?

Discover how AAVE, Ethereum, Solana, & BlockDAG are defining the 2025 crypto market with advancements in lending, speed, & blockchain technology.1. BlockDAG: Analysts Predict $20 by 20272. AAVE: Streamlining Digital Asset Borrowing3. Ethereum (ETH): Assessing Its Current Position in the Market4. Solana (SOL): Leading with Speed and EfficiencyFinal Say: Top Altcoins to Buy Now for 2025