Axelar ETF Filing Boosts AXL Price Amid Investor Excitement

- Canary Capital has filed an S-1 with the SEC for an ETF tracking Axelar’s AXL token.

- AXL’s price surged over 15% after the ETF filing, reflecting strong investor interest.

- Axelar has partnered with major firms, including J.P. Morgan, Microsoft, Uniswap, and MetaMask.

In a significant development for the cryptocurrency market, Canary Capital has filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) to launch an Axelar (AXL) ETF. The filing announcement led to a rapid surge in AXL’s price, with the token experiencing a 15% increase before stabilizing around $0.44. This reflects growing investor interest in blockchain interoperability solutions and the potential mainstream adoption of Axelar’s technology.

Axelar acts as a cross-chain interoperability protocol which connects blockchain networks including XRP Ledger, Solana, Bitcoin, and Ethereum. The protocol provides seamless transactions between diverse decentralized networks which places it as a fundamental component for blockchain advancement.

The company maintains an active position within the exchange-traded fund market. The firm has submitted previous applications for Solana, XRP and Litecoin ETFs reflecting growing institutional interest in crypto-based financial products. Most recently, its Litecoin ETF was listed on the DTCC platform under the ticker LTCC, fueling speculation of an upcoming approval.

Industry experts are closely watching Axelar’s rapid growth. The network has secured partnerships with major firms, including J.P. Morgan, Microsoft, Uniswap, and MetaMask. It also operates on a proof-of-stake consensus model, making it a decentralized solution for cross-chain transactions.

Axelar has also gained substantial institutional backing. Binance, Coinbase, Dragonfly, Galaxy, and Polychain are among its investors. In November 2024, Axelar surpassed $1 billion in total value locked (TVL), reinforcing its role in the blockchain ecosystem.

Related: Bitwise Files for Dogecoin ETF as Nasdaq Pushes Hedera ETF

For its growth, Axelar established an Institutional Advisory Board which recruited Brian Brooks as its member. Brooks, a former Coinbase Chief Legal Officer and U.S. Comptroller of the Currency brings regulatory expertise. His involvement signals Axelar’s push for greater institutional adoption.

Canary Capital CEO Steven McClurg expressed confidence in Axelar’s potential. He stated that Axelar has one of the strongest development teams in blockchain. He predicted that AXL could have the highest return in 2025 out of the tokens he is watching.

AXL’s price momentum reflects growing investor confidence. The token reached its historical peak at $2.69 during March 2014 and now holds a market cap of $409 million. As regulatory clarity improves, interest in blockchain interoperability solutions continues to rise.

In recent days market has witnessed many ETF applications with the change in administration and easing crypto rules. With institutional support, strategic partnerships, and regulatory momentum, Axelar is positioning itself as a leader in blockchain connectivity. Investors are now watching the SEC’s response to the ETF filing, which could open new opportunities for altcoin-based financial products.

The post Axelar ETF Filing Boosts AXL Price Amid Investor Excitement appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

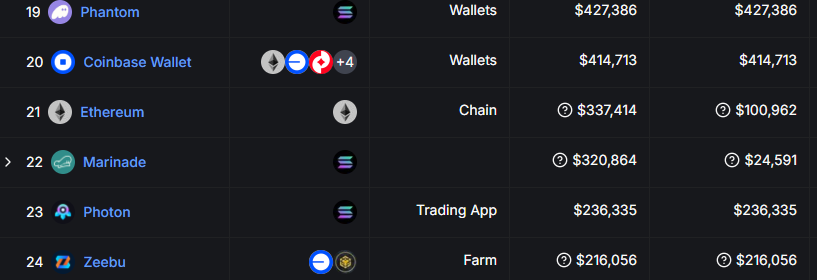

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.

Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.