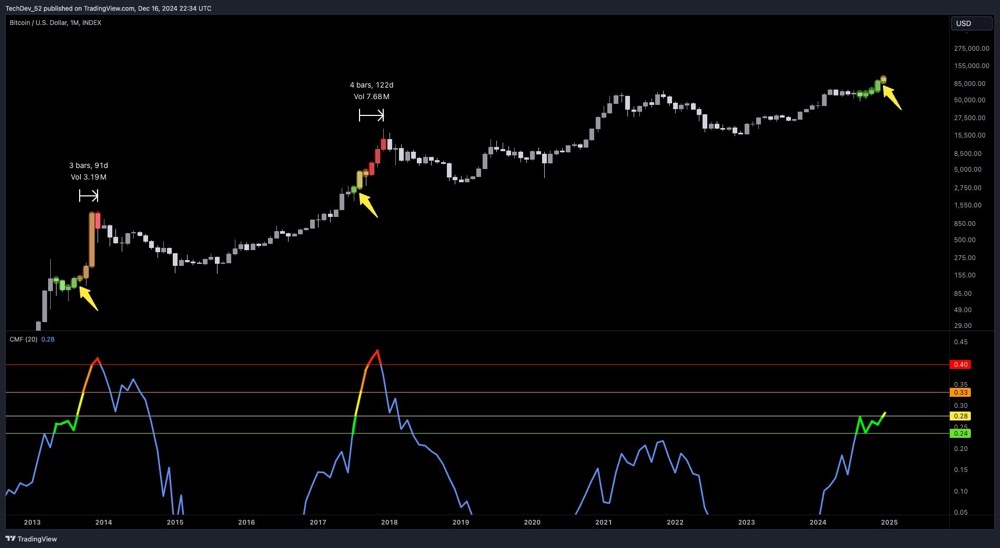

Bitcoin's key signal flashes: historical data suggests a violent rise in 3-4 months

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Long-term BTC holders are back in accumulation mode

Share link:In this post: The period of capitulation and spot selling has ended, and almost all wallet cohorts either hold or accumulate. 87.6% of the BTC supply is in profit, as the coin consolidates around $97,000. Short term buyers are in the money, feeling less pressure for wallets aged less than one month.

US stocks surge as jobs data eases recession fears, S&P 500 eyes 20-year win streak

Share link:In this post: The S&P 500 jumped 1.5% on Friday, heading for its longest winning streak since 2004. April payrolls beat expectations with 177,000 jobs added, easing recession fears. Apple dropped 3% after missing revenue targets, while Amazon rose slightly.

Three Key Scenarios for Bitcoin Price in 2025 – Could BTC Hit $175,000?

Hedera (HBAR) Struggles to Build Bullish Pattern in Tight Range